- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

3 Highly Shorted Stocks That Could Be the Next Wall Street Sensations

The meme-stock mania during the days of the pandemic was seen as a revolt of the ordinary retail investing public against the Wall Street giants. Armed with their zero-fee brokerage accounts on platforms like Robinhood (HOOD), a group of investors spearheaded by members of the Reddit (RDDT) group r/wallstreetbets shook the very foundations of giant hedge funds through a concerted effort of short-covering, resulting in overlooked names like GameStop (GME) and AMC (AMC) reaching new heights.

Now, after a lull of a few years, the frenzy is back, as a new wave of so-called meme-stocks like Kohl's (KSS), Opendoor (OPEN), Krispy Kreme (DNUT), and GoPro (GPRO) are having their moment in the sunshine. So, what are the next stocks that could catch a squeeze? A recent stock screener from CNBC highlighted three primary criteria: the short interest as a percentage of float should be above 30%; the company's market cap should be between $50 million and $2 billion; and the share price should be below $20. With those meme-stock guidelines in mind, here are 3 names to consider for momentum chasers.

#1. Airsculpt Technologies Stock

Founded in 2012, Airsculpt Technologies (AIRS) operates under the Elite Body Sculpture brand, providing minimally invasive body contouring procedures. Its proprietary AirSculpt® method removes unwanted fat and optionally transfers it to areas like the breasts, hips, or buttocks (e.g. Power BBL, Hip Flip, Up a Cup). The company's market cap currently stands at $388.5 million.

Shares of Airsculpt are up 13.9% on a YTD basis. AIRS leads the screener with a short interest of 53.1% and an average trading volume of 641,715 shares.

Airsculpt's results have been consistently poor, with just one bottom-line beat in the past nine quarters. The stock fell 10% Friday after Q2 2025 results, as well as the retirement of Chief Financial Officer Dennis Dean.

Looking ahead, AIRS reiterated its annual outlook for fiscal 2025 revenue in the range of $160 million to $170 million and adjusted EBITDA between $16 million and $18 million,

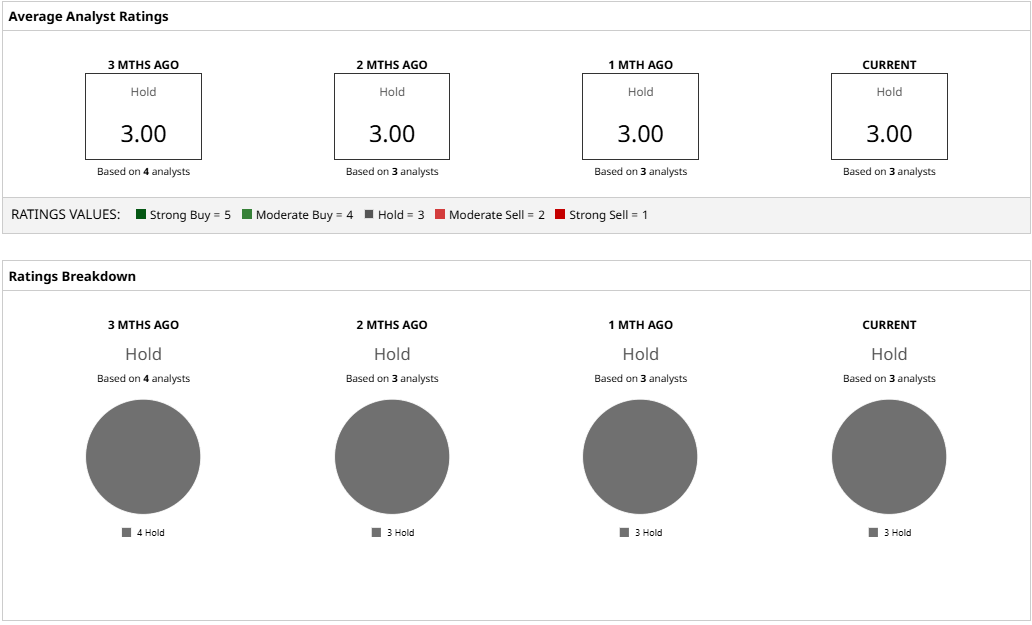

Overall, three analysts have unanimously deemed AIRS stock a “Hold.” The stock trades at a premium to its price target of $4.50.

#2. Children's Place Stock

Founded in 1969, Children's Place (PLCE) is a specialty retailer of children’s apparel, offering branded and private‑label clothing for newborns to pre‑teens, primarily via mall stores and online channels. The company has expanded to operate multiple proprietary brands including Gymboree, Sugar & Jade, and PJ Place under its portfolio.

Valued at a market cap of $106.5 million, PLCE stock is down 56.6% on a YTD basis. It is second on the CNBC screener's list of stocks with the most short interest at 50.2%.

Children's Place hasn't surpassed consensus earnings estimates for over a year, and the two most recent quarters were unprofitable, as well.

Net sales for Q1 2025 decreased by 9.6% from the previous year to $25.8 million as net losses widened to $1.52 per share from $1.18 per share in the prior year. Store count also diminished to 495 from 518 in the year-ago period.

Although net cash outflow from operating activities narrowed, it remained substantial at $42.9 million, compared to $110.8 million in the previous year. Overall, Children's Place ended Q1 with a cash balance of $5.7 million, compared to its short-term debt levels of $351.5 million.

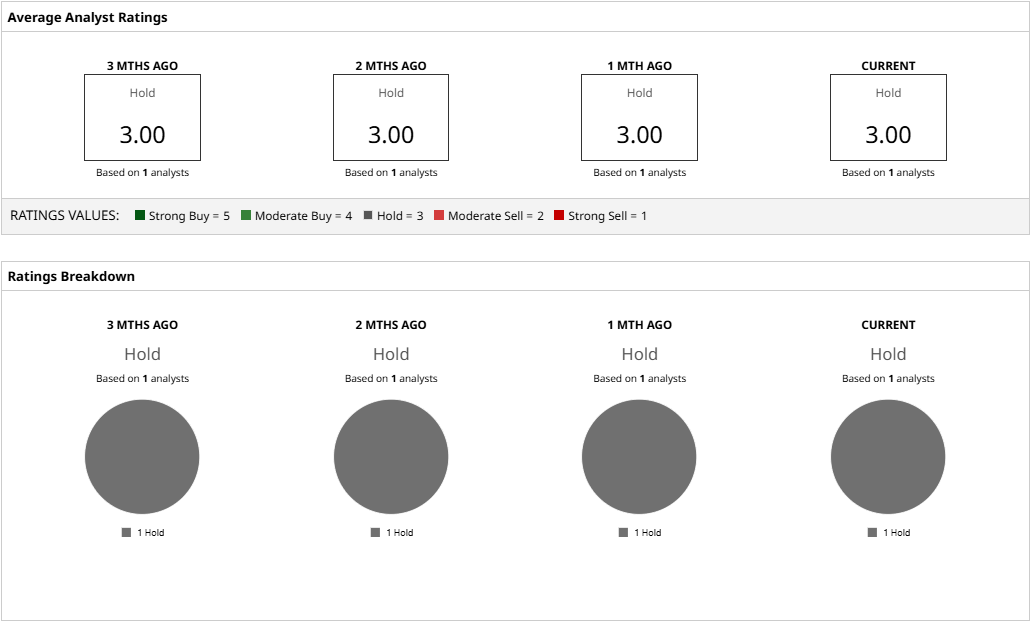

Children's Place has limited coverage on Wall Street, with just a single “Hold” rating and a target price of $6. This denotes expected upside of about 32% from current levels.

#3. Zenas Biopharma Stock

We conclude our list with Zenas Biopharma (ZBIO), which was founded in 2019. It is a clinical-stage biopharmaceutical company focused on developing immunology-based therapies, particularly for autoimmune and inflammatory conditions.

Valued at a market cap of $657.2 million, ZBIO stock has rallied 88.2% on a YTD basis. It has a short interest of 50.1%.

Zenas has a limited quarterly earnings history, with its IPO as recent as September 2024. In Q1 2025, the company reported revenues of $10 million and losses of $0.80 per share, which came in better than the consensus estimate of a loss of $1.13 per share.

Net cash used in operating activities widened to $37 million from $19.1 million in the year-ago period as the company closed the quarter with a cash balance of $196.5 million. This compares to its short-term debt levels of $20.9 million.

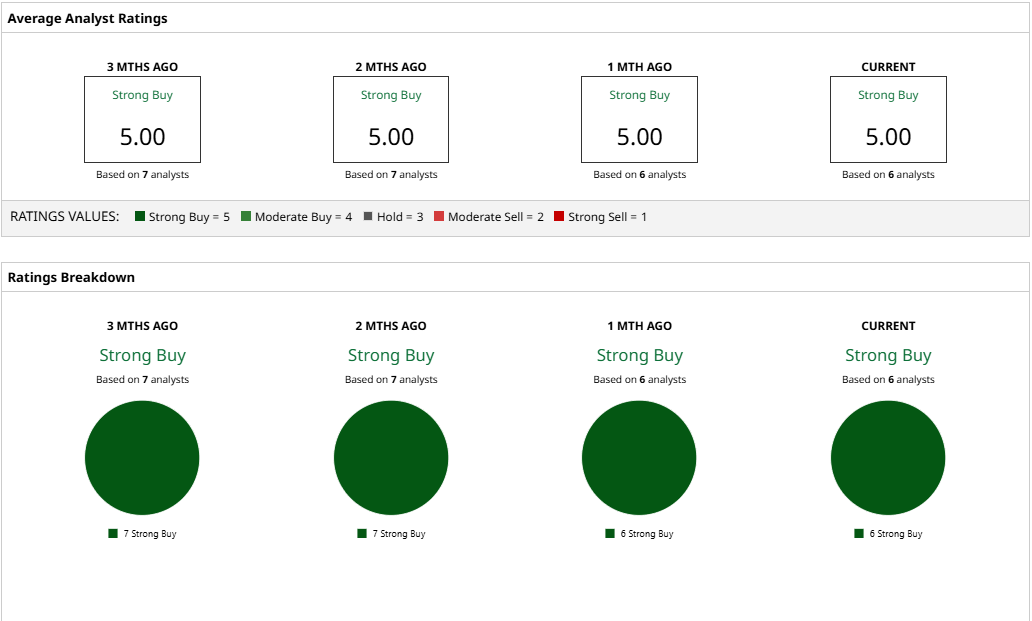

ZBIO is the only company on this list that has a bullish rating from Wall Street analysts, primarily due to its product pipeline and research initiatives. The stock has been unanimously deemed a “Strong Buy” by six analysts, with a mean target price of $32.33. This denotes an upside potential of about 109% from current levels.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.